MMT incorporates sector models, which date back to Keynes and play a role in neo- and post-Keynesianism, of the economy which gives, IMO, a key insight into the way a typical sovereign economy may function. The model usually used is one of a three-sector model, government, the private sector and a foreign sector as ‘rest of world’.

There is an aggregation of individual accounts into overall national accounts. According to the principles of double-entry bookkeeping, all financial assets are another’s financial liabilities. All accounts together – private, public, foreign – sum to be zero. In a three sector model at least one of the three has run a net surplus, while at least one of the other two has to run a deficit.

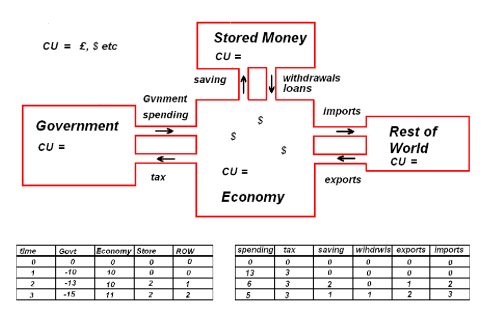

In principle the division can be of any number from two upwards. This model divides the private sector into the active economy where the money supplied to it changes hands at least once in the course of an arbitrary time period, say a month, and stored private money where money doesn’t change hands, or if it does, moves from one account to another in a way that does not affect the active economy.

The active economy is where people earn their living, by selling their labour power, and buy commodities which are the necessities of life. It is the one that matters to most people but of course does not exist in isolation.

Stored private money would normally be tied up in savings accounts, long term investments such as government bonds, but equally it could be stored as cash under a proverbial mattress or even in a child’s piggy bank. Active money is the sort normally held in our current, or checking, accounts, and in our purses and wallets.

The model shows that Government Spending, Withdrawals and Loans and Exports payments all will add currency units CUs to the active economy and can be considered inflationary

The model shows that Government Spending, Withdrawals and Loans and Exports payments all will add currency units CUs to the active economy and can be considered inflationary

Taxation, Savings, and Import payments will remove money and can be considered to be deflationary.

For illustrative purposes only, the left side table show CU levels at time period t. The right side table shows CU movements.

Starting at time t=0 we can assume zero levels. Further we assume a’ready to go’ economy.

At time t=1 we can conceptualise the ‘kick-starting’ of the economy by a government expenditure of 13 CUs. Simultaneously taxation (3 CUs) is required to establish the value of these CUs. This leaves 10 CUs of fast moving money in the active economy. 10 CUs is the set target.

At time t=2 Government spends an extra 6 CUs, taxes 3 CUs. The private sector saves 2 CUs. There are 1 Cus of exports and 2 Cus of imports.

The position is still 10 CUs of active money in the economy.

At t=3 Government spends 5 CUs and taxes at 3 CUs. Savings andwithdrawals are both 1 CUs. Exports are 2 and Imports are 3,

This leaves 11 CU’s in the economy. One higher than the target. This can be corrected later or left as is of course.

There are several important things to note from this simple model:

- Government has a strong influence on the workings of an economy but it is not in total control. Except in special times like wartime, it would not be able or willing to sufficiently control the savings and desire for loans of the private sector.

- As stores of money are built up by the private and overseas sectors, so too does the level of Government debt. One is the inverse of the other.

- Wealthier members of the private sector, and the thrifty members too, contribute more to Government debt than the less wealthy and less thrifty .

- Running a continuous trade deficit increases levels of government debt and/or reduces the stored money of the private sector.

- Government debt is necessary to create private wealth.

Implications for Real economies

1) The USA

The USA has a total government debt of around $17 trillion.

http://en.wikipedia.org/wiki/National_debt_of_the_United_States

Of this ~$5 trillion was owned by the overseas sector. ~$5 trillion is owned by intragovernmental organisations ~$7 trillion by the US private sector.

The argument is often made in MMT circles that no matter what the size of any government deficit, or debt, the government can never involuntarily default. It is the ‘government checks never bounce’ argument’ which is now well established.

But, if the US doesn’t have a debts problem, could it have an assets problem? Could the size of assets (stored money) held by the private and overseas sectors ever become so large they threaten to destabilise the US economy? The owners of these assets are could well consider that what we argue are necessary fiscal measures to reduce unemployment levels, to be highly inflationary. They may well be wrong in thinking that, but is it possible they could bring about that inflation by spending wildly, on anything and everything, outside of government control, before the $ lost too much of its purchasing power?

A little extra inflation would probably be a good thing but could it get out of hand?

To be continued.