MMT incorporates sector models, which date back to Keynes and play a role in neo- and post-Keynesianism, of the economy which gives, IMO, a key insight into the way a typical sovereign economy may function. The model usually used is one of a three-sector model, government, the private sector and a foreign sector as ‘rest of world’.

There is an aggregation of individual accounts into overall national accounts. According to the principles of double-entry bookkeeping, all financial assets are another’s financial liabilities. All accounts together – private, public, foreign – sum to be zero. In a three sector model at least one of the three has run a net surplus, while at least one of the other two has to run a deficit.

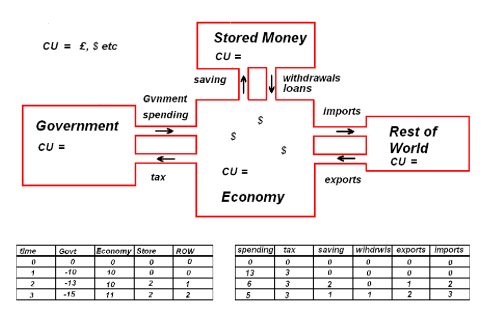

In principle the division can be of any number from two upwards. This model divides the private sector into the active economy where the money supplied to it changes hands at least once in the course of an arbitrary time period, say a month, and stored private money where money doesn’t change hands, or if it does, moves from one account to another in a way that does not affect the active economy.

The active economy is where people earn their living, by selling their labour power, and buy commodities which are the necessities of life. It is the one that matters to most people but of course does not exist in isolation.

Stored private money would normally be tied up in savings accounts, long term investments such as government bonds, but equally it could be stored as cash under a proverbial mattress or even in a child’s piggy bank. Active money is the sort normally held in our current, or checking, accounts, and in our purses and wallets.

The model shows that Government Spending, Withdrawals and Loans and Exports payments all will add currency units CUs to the active economy and can be considered inflationary

The model shows that Government Spending, Withdrawals and Loans and Exports payments all will add currency units CUs to the active economy and can be considered inflationary

Taxation, Savings, and Import payments will remove money and can be considered to be deflationary.

For illustrative purposes only, the left side table show CU levels at time period t. The right side table shows CU movements.

Starting at time t=0 we can assume zero levels. Further we assume a’ready to go’ economy.

At time t=1 we can conceptualise the ‘kick-starting’ of the economy by a government expenditure of 13 CUs. Simultaneously taxation (3 CUs) is required to establish the value of these CUs. This leaves 10 CUs of fast moving money in the active economy. 10 CUs is the set target.

At time t=2 Government spends an extra 6 CUs, taxes 3 CUs. The private sector saves 2 CUs. There are 1 Cus of exports and 2 Cus of imports.

The position is still 10 CUs of active money in the economy.

At t=3 Government spends 5 CUs and taxes at 3 CUs. Savings andwithdrawals are both 1 CUs. Exports are 2 and Imports are 3,

This leaves 11 CU’s in the economy. One higher than the target. This can be corrected later or left as is of course.

There are several important things to note from this simple model:

- Government has a strong influence on the workings of an economy but it is not in total control. Except in special times like wartime, it would not be able or willing to sufficiently control the savings and desire for loans of the private sector.

- As stores of money are built up by the private and overseas sectors, so too does the level of Government debt. One is the inverse of the other.

- Wealthier members of the private sector, and the thrifty members too, contribute more to Government debt than the less wealthy and less thrifty .

- Running a continuous trade deficit increases levels of government debt and/or reduces the stored money of the private sector.

- Government debt is necessary to create private wealth.

Implications for Real economies

1) The USA

The USA has a total government debt of around $17 trillion.

http://en.wikipedia.org/wiki/National_debt_of_the_United_States

Of this ~$5 trillion was owned by the overseas sector. ~$5 trillion is owned by intragovernmental organisations ~$7 trillion by the US private sector.

The argument is often made in MMT circles that no matter what the size of any government deficit, or debt, the government can never involuntarily default. It is the ‘government checks never bounce’ argument’ which is now well established.

But, if the US doesn’t have a debts problem, could it have an assets problem? Could the size of assets (stored money) held by the private and overseas sectors ever become so large they threaten to destabilise the US economy? The owners of these assets are could well consider that what we argue are necessary fiscal measures to reduce unemployment levels, to be highly inflationary. They may well be wrong in thinking that, but is it possible they could bring about that inflation by spending wildly, on anything and everything, outside of government control, before the $ lost too much of its purchasing power?

A little extra inflation would probably be a good thing but could it get out of hand?

To be continued.

Very, very nice!

“Wealthier members of the private sector, and the thrifty members too, contribute more to Government debt than the less wealthy and less thrifty”

This quote was from the head post but I am not sure if this is a direct excerpt from the MMT book or not. It is ambiguous because it is not the wealthy and/or the thrifty that contributes to Govt debt, they certainly may hold some paper over this debt but isn’t the privileged companies and business owners that receive Govt subsidies and the poor that receive welfare payments that contributes mainly to Govt debt?

Congratulations on a neat website.

Hi Peter,

Thanks for dropping by.

I’m not sure why it should be but the MSM don’t really explain what a National debt actually is. Most Americans are horrified that their debt has actually reached $17 trillion. Every couple of years the US Congress tie themselves, and the entire nation, in knots when a ceiling is reached and has to be raised.

Its natural that every government should have one. Open up your wallet and you may see a $100 or so worth of government debt. You may have a bank account with a few thousand dollars of government debt in it. The wealthier and the more thrifty you are, the more debt you’ll hold. Its not necessarily a bad thing, but then neither is government debt.

Governments have to create the debt for individuals to hold so in that sense they are responsible for it. I’m pretty sure Australia’s Future fund isn’t what its claimed to be. I haven’t fully understood it yet but I suspect that it’s an accountancy trick to actually create Government debt when it was in short supply a few years ago. The financial world just love Government debt. They can’t get enough of it!

I like it!!! But can I suggest some re-phrasing. My attempt at re-phrasing involves more words (unfortunately).

Re the bullet point near the end “Government has a strong influence…”, I think it would be more accurate to say something like “In theory government has complete control over aggregate demand in the sense that it can create limitless amounts of money out of thin air and spend it into the economy (and/or cut taxes) so as to counteract any reduced demand coming from a decline in exports or increased saving by the private sector. That theoretical control is not easy to put into practice with complete precision, but trying to implement a measure of control of the latter sort is better than doing nothing.”

Re the last bullet point “Government debt is necessary to create private wealth.”, that’s a red rag to right wing bulls. They’ll claim that the private sector could create plenty of wealth if government pretty much disappeared off the face of the Earth. And they’d have a point. My version (which has the disadvantage of being longer) would read:

“It’s obvious from the 1800s and early 1900s that severe slumps in demand occur in free markets. Those slumps can be ameliorated if government issues liabilities (debt or monetary base). And issuing those liabilities equals increasing private sector paper assets, which increases demand.”

Ralph,

Thanks for the comment. A government free world is an interesting concept. My guess is that if all current governments were ever to somehow be abolished , the private sector would have to re-invent their own government. They would have to incorporate the principle of democracy to establish some legitimacy. We’d end up pretty much with what we already have IMO!

I should perhaps make it clear that my comments refer to economies operating with a fiat currency. They don’t necessarily apply to convertible commodity currencies.

What we saw historically is that if you have high inflation, you have such a high nominal GDP growth that your stock of savings would shrink as a percentage of GDP. So for those people who worry about debt to GDP, high inflation eliminates the “problem”.

As for spending driving up Inflation, you probably need people buying stuff that is labour intensive, We have some people worrying about inflation now, but they are buying things like art or gold, which is not going to raise the wages of the broad public.

@Peter

Should spending sufficient to generate significant inflation occur in a nation as vastly productive as the United States, automatic stabilizers would push the government into surplus and draining financial assets from the non-governmental sector. That’s the real-time brake on a debilitating spending spree.